rhode island income tax rate 2021

Your average tax rate is. Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550.

State Income Tax Rates Highest Lowest 2021 Changes

Complete your 2021 Federal Income Tax Return first.

. Find your pretax deductions including 401K flexible account contributions. Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Read the summary of the latest tax changes.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. TAXES 21-18 Rhode Island State Income Tax Withholding. Tax rate of 475 on taxable.

The annualized wage threshold where the annual exemption amount is eliminated has changed from 231500 to 234750. Line 8a and 8b - Rhode Island Total TaxFee. Rhode Island Corporate Income Tax Comparison A home business grossing 55000 a year pays 385000 A small business earning 500000 a year pays 350000 A corporation earning 10000000 a year pays 70000000 12 -.

Ad Compare Your 2022 Tax Bracket vs. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax 5. It is the basis for preparing your Rhode Island income tax return.

How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table 1. Any income over 150550 would be taxes at the highest rate of 599. Use this tool to compare the state income taxes in Massachusetts and Rhode Island or any other pair of states.

For tax year 2021 the property tax relief credit amount increases to 415 from 400. You filed your tax return now - Wheres My Refund. The income tax is progressive tax with rates ranging from 375 up to 599.

Rhode Island reduced its corporate income tax rate for C corporations from 9 to 7 as of January 1 2015. How to contact us make payments or use our drop box. Rhode Island Income Tax Calculator 2021 If you make 135500 a year living in the region of Rhode Island USA you will be taxed 28671.

The amount of your expected refund rounded to the nearest dollar. Guide to tax break on pension401kannuity income. Read our latest newsletter.

Your standard deduction amount is zero 0. Subtract line 4 from line 2 If the result is more than 24000 STOP HERE. For example if your expected refund is.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. In gen- eral the Rhode Island income tax is based on your federal adjusted gross income. RI 1040 H Only.

Nonresidents and part-year residents will file their Rhode Island Individual Income Tax Returns using Form RI-1040NR. Your 2021 Tax Bracket to See Whats Been Adjusted. This tool compares the tax brackets for single individuals in each state.

The income tax withholding for the State of Rhode Island includes the following changes. Tax Rate Schedule RI Tax Tables NEW FOR 2021. Rhode Island Tax Brackets for Tax Year 2021 As you can see your income in Rhode Island is taxed at different rates within the given tax brackets.

Enter 0 on form RI-1040 or RI-1040NR Page 1 line 4. Rhode Island standard deduction amounts by tax year Filing status 2020 2021 Single 8900 9050 Married filing jointly 17800 18100 Head of household 13350 13550 Married filing separately 8900 9050 Or qualifying widow or widower. Line 7a - Rhode Island Annual Fee Enter the amount of 40000 on this line.

Increased Federal AGI amounts for the social security the pension and annuity modifications. For more information about the income tax in these states visit the Massachusettsand Rhode Islandincome tax pages. Find your gross income 4.

Get Your Max Refund Today. Reminder about taxes on unemployment benefits. Pay Period 06 2021.

4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. Find your income exemptions 2. Subscribe for tax news.

3 rows Tax rate of 375 on the first 65250 of taxable income. Deadline extended for certain exemption certificates. March 30 2021 Effective.

Pursuant to RIGL 44-11-2e the minimum tax imposed shall be 40000 Line 7b - Jobs Growth Tax Enter 5 of the aggregate performance-based compensation paid to eligible employees as per the Jobs Growth Act 42-6411-5. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. RHODEISLAND RESIDENCY PERIOD BE SURE TO CHECK THE BOX ON LINE15b.

Discover Helpful Information and Resources on Taxes From AARP. RI-1040H 2021 2021 RI-1040H Rhode Island Property Tax Relief Claim PDF file about 2mb RI-1040MU 2021 Credit for Taxes Paid to Other State multiple PDF file less than 1mb RI-1040NR 2021 Nonresident Individual Income Tax Return PDF file about 11mb RI-1040NR - Schedule II 2021 Full Year Nonresident Tax Calculation PDF file less than 1mb. Enter the applicable percentage from the chart below 7.

Those under 65 who are not disabled do not qualify for the credit. Check the status of your state tax refund. 3 rows This page contains references to specific Rhode Island tax tables allowances and thresholds.

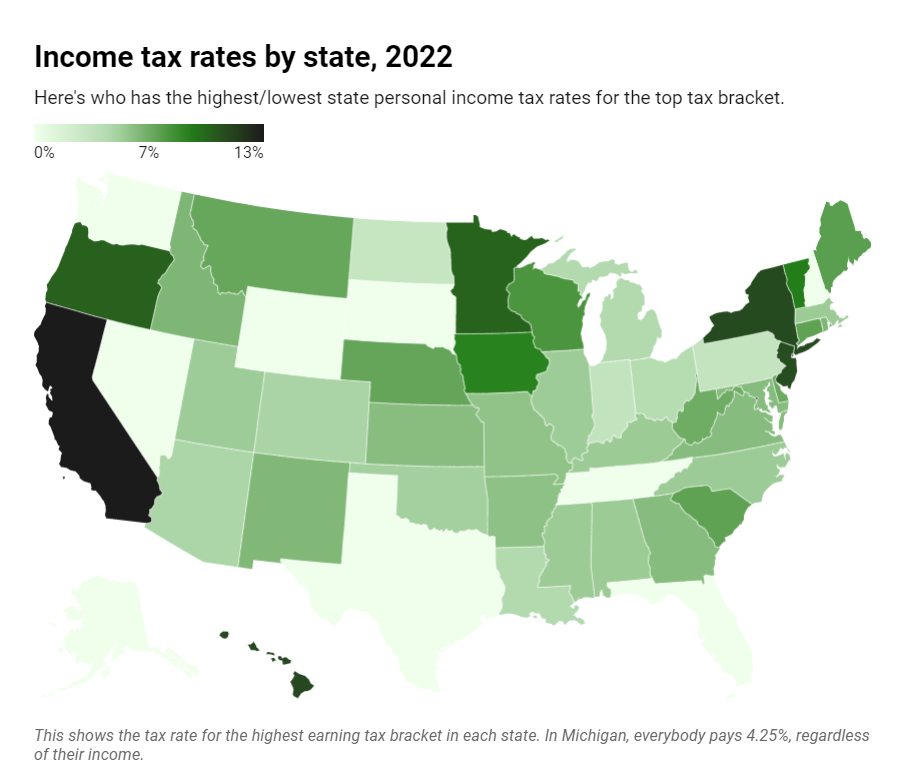

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Reciprocal Agreements By State What Is Tax Reciprocity

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

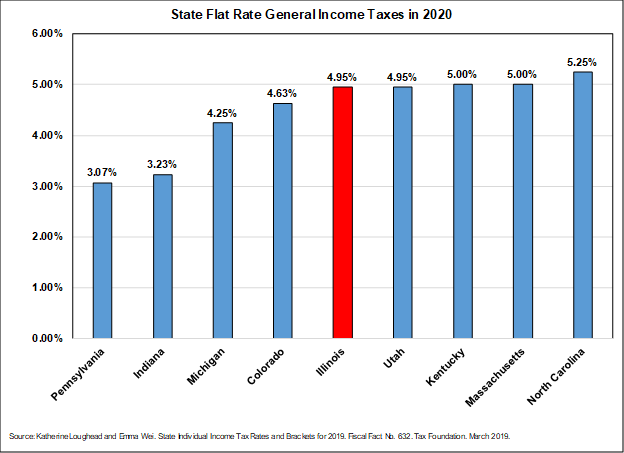

Individual Income Tax Structures In Selected States The Civic Federation

States With Highest And Lowest Sales Tax Rates

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Colorado Income Tax Rate And Brackets 2019

Chart Uk Tax Burden To Hit Highest Level Since The 60s Statista

How Is Tax Liability Calculated Common Tax Questions Answered

Monday Map Top State Income Tax Rates Tax Foundation

Income Tax Calculator 2021 2022 Estimate Return Refund

Historical Rhode Island Tax Policy Information Ballotpedia

How High Are Capital Gains Taxes In Your State Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)