wake county nc sales tax calculator

The calculator should not be used to determine your actual tax bill. This is the total of state and county sales tax rates.

How To Calculate Sales Tax A Simple Guide Bench Accounting

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

. Learn about listing and appraisal methods appeals and tax relief. Your county vehicle property tax due may be higher or lower depending on other factors. 475 North Carolina State Sales Tax -200 Maximum Local Sales Tax 275 Maximum Possible Sales Tax 690 Average Local State Sales Tax.

30 rows The state sales tax rate in North Carolina is 4750. The December 2020 total local sales tax rate was also 7250. Historical County Sales and Use Tax Rates.

There is no city sale tax for raleigh. The North Carolina sales tax rate is currently. The 2018 United States.

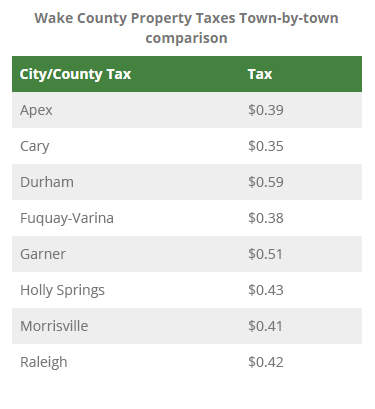

The current total local sales tax rate in wake county nc is 7. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. 2000 x 9730 194600.

Plus 20 Recycling fee 196600 estimated annual tax. Sales Tax Rate s c l sr Where. North Carolina Department of Revenue.

Sales tax in Wake County North Carolina is currently 725. As a way to measure the quality of schools we analyzed the math and readinglanguage. PO Box 25000 Raleigh NC 27640-0640.

The Wake County sales tax rate is. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Contact your county tax.

The Wake Forest sales tax rate is. How 2021 sales taxes are calculated in raleigh. The raleigh sales tax rate is 0.

All numbers are rounded in the normal fashion. Wake Forest is in the following zip codes. S North Carolina State Sales Tax Rate 475 c County Sales Tax Rate l Local Sales Tax Rate sr Special Sales Tax Rate.

The median property tax on a 22230000 house is 180063 in Wake County. The current total local sales tax rate in Wake Forest NC is 7250. The minimum combined 2022 sales tax rate for Wake Forest North Carolina is.

County rate 60 Raleigh rate 3730 Combined Rate 9730 Recycling Fee 20. Did South Dakota v. North Carolina Department of Revenue.

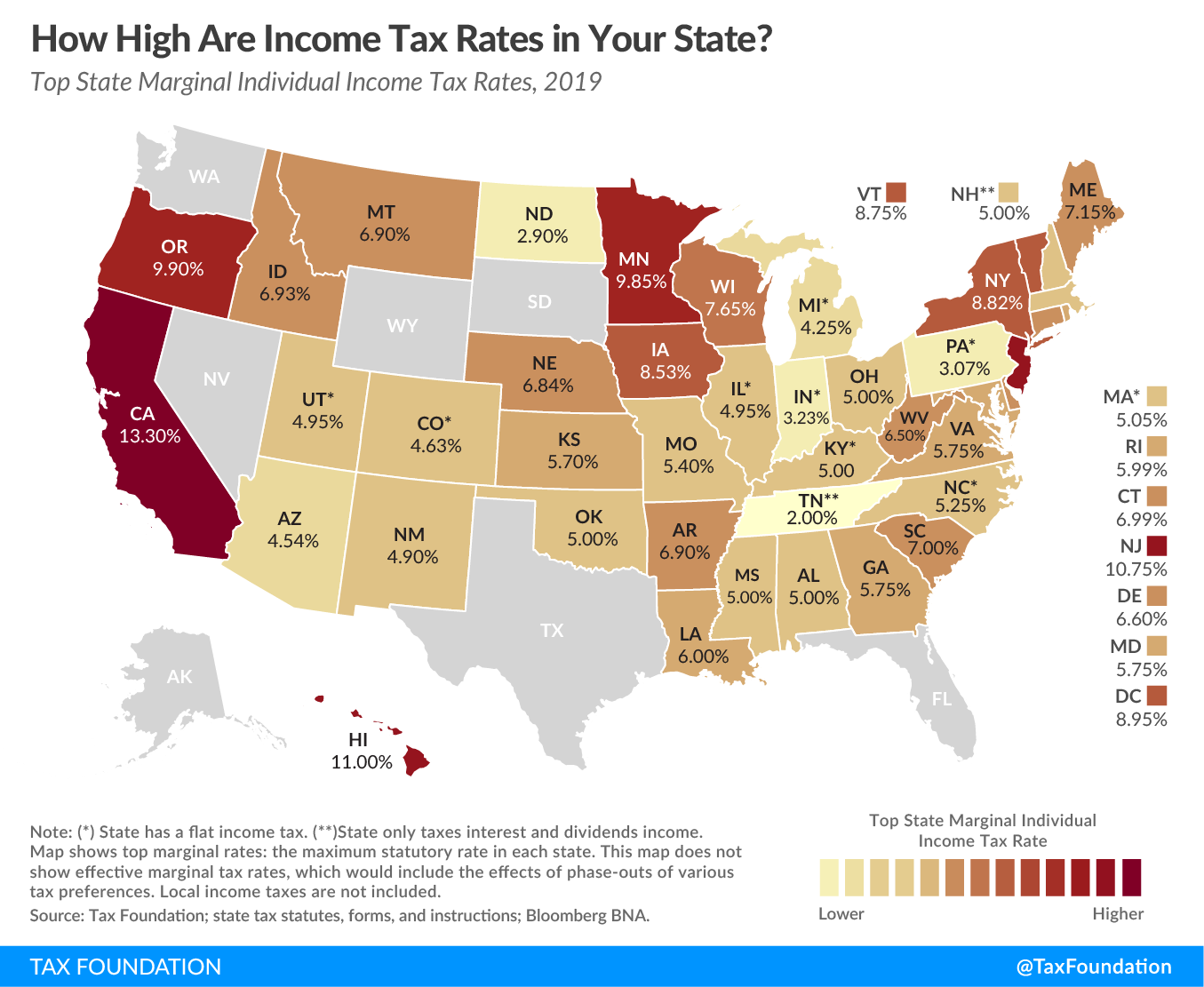

The median property tax on a 22230000 house is 233415 in the United States. North Carolina has a 475 statewide sales tax rate but also has 323 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2188. The current total local sales tax rate in West Raleigh NC is 7250The December 2020 total local sales tax rate was also 7250.

Property value divided by 100. To calculate the sales tax amount for all other values use our sales tax calculator above. How much is sales tax in Wake County in North Carolina.

This calculator is designed to estimate the county vehicle property tax for your vehicle. Fast Easy Tax Solutions. The 725 sales tax rate in raleigh consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 725 in Wake Forest North Carolina. 2022 Cost of Living Calculator for Taxes. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates.

Historical Total General State Local and Transit Sales and Use Tax Rates. View statistics parcel data and tax bill files. Search real estate and property tax bills.

Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75. This is the total of state county and city sales tax rates. Please enter the following information to view an estimated property tax.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. The north carolina nc state sales tax rate is currently 475. Wayfair Inc affect North Carolina.

Individual income tax refund inquiries. The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake County North Carolina Sales Tax Comparison Calculator for 202223. The property is located in the City of Raleigh but not a Fire or Special District.

Sales Tax Breakdown Wake Forest Details Wake Forest NC is in Wake County. The County sales tax rate is. The median property tax on a 22230000 house is 173394 in North Carolina.

The North Carolina state sales tax rate is currently. Wake County NC Sales Tax Rate Wake County NC Sales Tax Rate The current total local sales tax rate in Wake County NC is 7250. All Zip Codes in Wake Forest North Carolina 27587 27588.

You can print a 725 sales tax table hereFor tax rates in other cities see North Carolina sales taxes by city and county. PO Box 25000 Raleigh NC 27640-0640. Pay tax bills online file business listings and gross receipts sales.

This table shows the total sales tax rates for all cities and towns in Wake County including all local taxes. A single-family home with a value of 200000. Ad Find Out Sales Tax Rates For Free.

Find your North Carolina combined state and local tax rate. North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. North Carolina Sales Tax Rates by Zip Code.

Historical Total General State Local and Transit Sales and Use Tax Rates. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. Wake county nc sales tax calculator.

Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax North Carolina QuickFacts. The December 2020 total local sales tax rate was also 7250. North Carolina sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Here are pictures specs and pricing for the 2022 volkswagen tiguan se located near raleigh. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

Taxes Cary Economic Development

Wake County Nc Property Tax Calculator Smartasset

Taxes Wake County Economic Development

North Carolina Sales And Use Tax Audit Guide

Property Tax Calculator Casaplorer

Taxes Cary Economic Development

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Property Tax In North Carolina

North Carolina Income Tax Calculator Smartasset

Taxes Cary Economic Development

North Carolina Sales Tax Small Business Guide Truic

Wake County North Carolina Property Tax Rates 2020 Tax Year

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

North Carolina S Transition To A Low Tax State

School Reviews For Wake County School District School District Wake County School Reviews

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Arizona Capitol Times