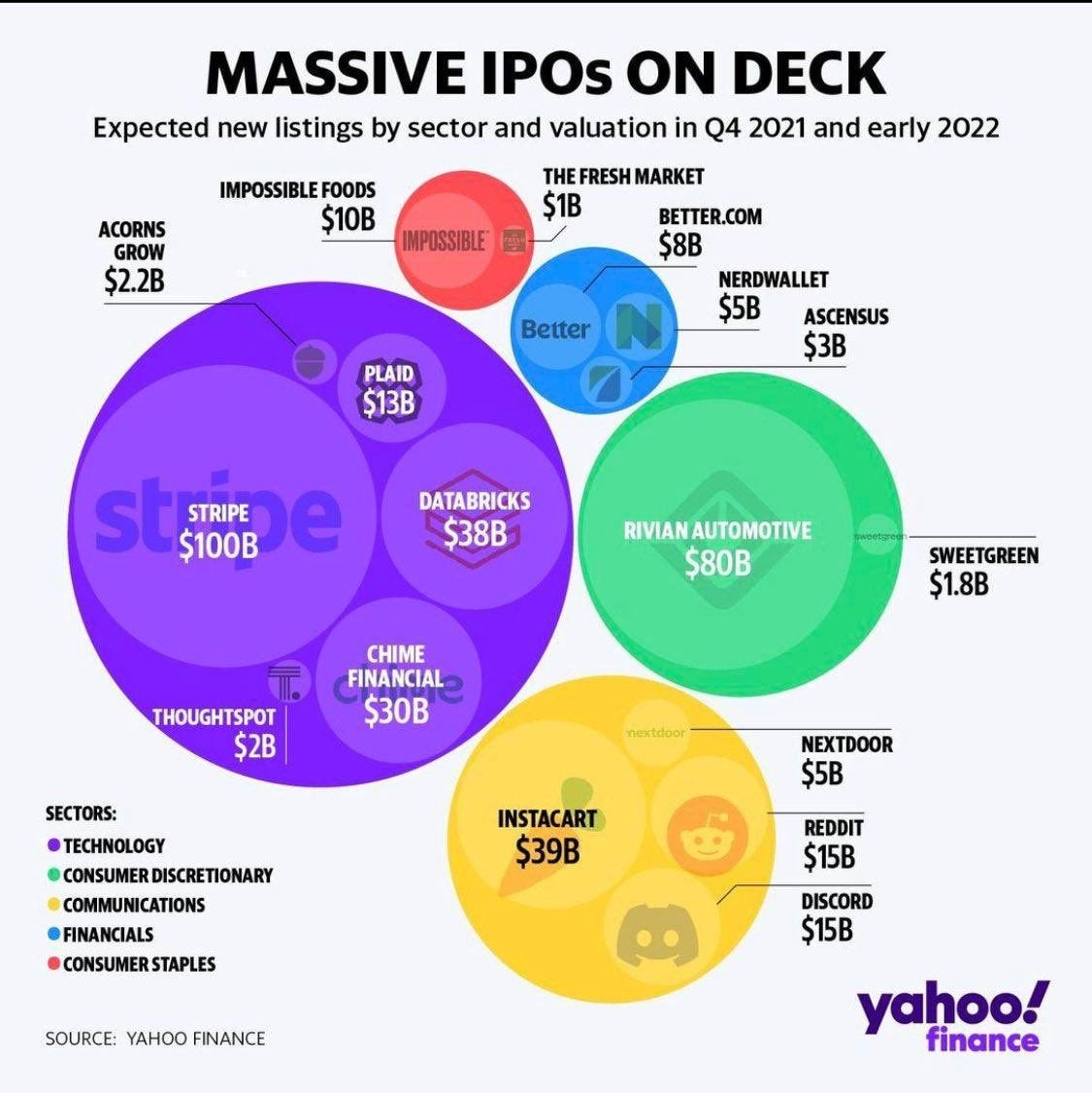

impossible foods ipo spac

Impossible Foods rival Beyond Meat held its IPO on May 2 2019 pricing at 25 per share. Impossible Foods Inc was preparing for public listing as far back as April 2021.

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Use our free directory to instantly connect with verified IPO attorneys.

. The three guys and some office space eventually became Toast a provider of software and hardware to restaurants that held its New York Stock Exchange debut on. Today were pleased to announce our completed acquisition of Zymergen. Ginkgo completes acquisition of Zymergen.

Impossible Foods is exploring going public through an initial public offering IPO in the next 12 months or a merger with a so-called special purpose acquisition company SPAC the. Impossible Foods is exploring options to go public either via traditional IPO or SPAC according to Reuters. The company is one of the largest in the plant-based food market and a.

According to the sources the firm will go public through a standard IPO or a SPAC. As of June 2022 the company was valued at. Food and drink sales in the 1970s were pegged at 428 billion.

In April 2021 when Impossible Foods was first reported to be seeking an IPO Beyond. Impossible Foods is exploring going public through an initial public offering IPO in the next 12 months or a merger with a so-called special purpose acquisition company SPAC the. Restaurant industry has grown significantly over the last half-century.

This is our largest acquisition to date. Impossible Foods is exploring going public through an IPO initial public offering or a merger with a SPAC special purpose acquisition company in the next 12 months according. Impossible Foods archrival Beyond Meat made its public debut in a 240 million IPO in May 2019.

The valuation at that time was noted at. In April 2021 sources informed Bloomberg that Impossible Foods is planning an IPO soon. If this is the case its worth far more than Beyond Meat was at the time of its listing the company secured a 146 billion market cap post-IPO.

Compare the best IPO lawyers near Medford NY today. 3Impossible Foods Inc is preparing to go public via SPAC or IPO route. In November 2021 Impossible.

The Impossible foods IPO Plan Impossible Foods counts nearly 25000 grocery stores and 40000 restaurants as its customers. The company held a 146 billion valuation at the time.

Impossible Foods Explores Spac Or Ipo R Spacs

Impossible Foods Prepping For 10 Billion Ipo Report Marketwatch

Impossible Foods Eyes 7b Valuation Founder Hints At Inevitable Ipo

Impossible Foods Ipo What You Need To Know

The Impossible Foods Ipo Will Rise With This Secret Ingredient

Exclusive Impossible Foods In Talks To List On The Stock Market Sources Reuters

The Stockout Honest And Impossible Cpg Companies That May Go Public Soon Freightwaves

Impossible Foods Reportedly Preparing For Ipo With Us 10 Billion Valuation

Coatue Leads Us 200m Funding Round For Impossible Foods Bnn Bloomberg

Impossible Foods Ipo What You Need To Know

12 Spacs That Could Bring Impossible Foods Public

Ipos Spac Calendar 2021 Among Some Of The Most Expected By Bogdan Florin Ceobanu Medium

Impossible Foods In Talks To List On The Stock Market Fox Business

Impossible Foods In Talks To List On The Stock Market Reports Hospitality Ireland

Impossible Foods Exploring Options For Ipo Or Merger With Spac Report

Impossible Foods In Discussions For Potential Ipo Or Spac Merger Equities News

Impossible Foods研spac上市 蘋果日報 聞庫

Impossible Foods Ipo How To Invest In Impossible Foods Vegpreneur

Impossible Foods Could Have An Ipo In 2021 Hedzh Fond Global Secure Invest Sootvetstvuyushij Evropejskim Standartam I Trebovaniyam Aifmd